If firms want to go green then we should give shareholders the keys to their plans

- May 19, 2022

- 2 min read

While the finance sector can feel distant and detached, people are waking up to the impact it can have on our environment. Which bank, building society, or investment fund we decide to deposit our savings, store our pensions, or pay our hard-earned salaries into can determine whether green projects and clean businesses are financed.

That’s why, increasingly, people want a say over the ventures the finance sector funds using their money. A survey by the Financial Conduct Authority found that 80 per cent want their money to do some good, while 71 per cent want to see their funds used to protect the environment and not used for unethical investments.

This growing demand for ethical and green investments is why financial products like green mortgages are booming. Leeds Building Society found that four out of five mortgage brokers saw the number of inquiries into these new loans grow, with 43 per cent of people surveyed saying they would choose a green mortgage over other deals.

As energy bills go up, the sustainable way forward is to upgrade our buildings and insulate draughty homes – but this will take billions of pounds. Green mortgages help by offering a lower rate for well-insulated homes, encouraging homeowners to upgrade before selling or allowing buyers an increased loan amount to invest in energy efficiency improvements.

But as well as letting individual consumers make greener choices to unlock investment for achieving net zero, we need to empower the shareholders of banks, building societies and finance firms too. They can encourage a shift in investments through collective resolutions. Organisations like ShareAction show shareholders’ power in pushing for greener investments, pressing for investment in renewables and energy efficiency instead of fossil fuels.

But these shareholders should have a vote on their company’s plan for transitioning to net zero. We’ve seen a rise in shareholder activism, but this doesn’t require billions of pounds, it gives those with a financial stake in the business a say over its green aspirations. It will hold companies to account, without requiring top-down intervention from the government.

Green finance is an increasingly important part of London’s financial and professional services offering, keeping the capital ahead of other international destinations, including New York, Singapore, Hong Kong, Paris, and Frankfurt. The government has already said climate-related financial disclosure should be mandatory, and told listed companies to develop roadmaps to net zero. But putting in mechanisms of accountability will ensure the durability of the industry.

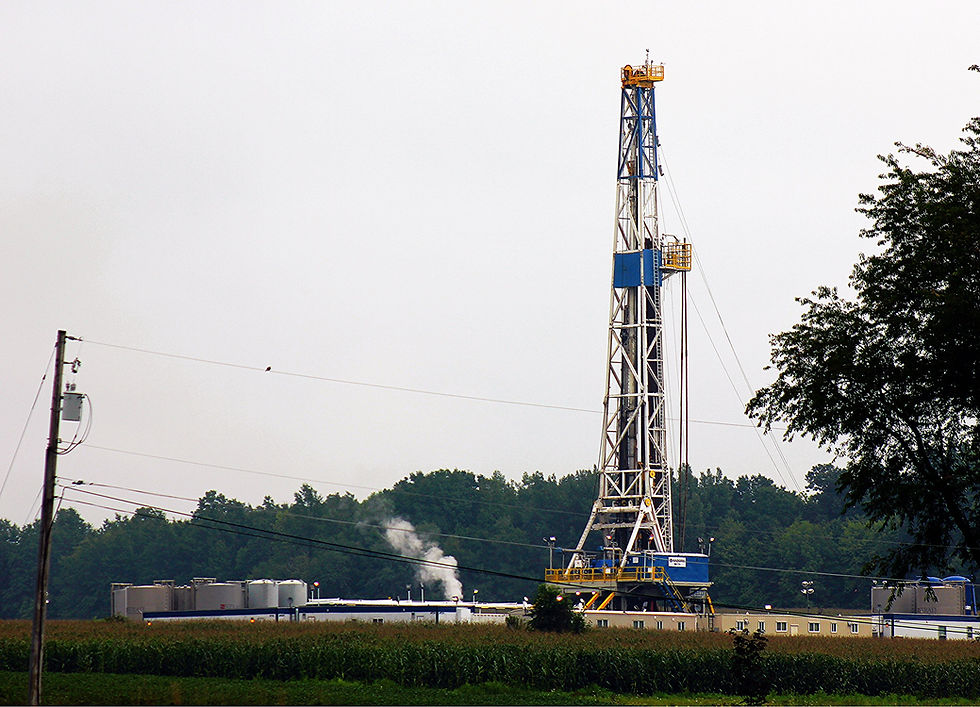

Climate change is the long-term challenge facing the finance industry; fossil fuel investments today may deliver, but not for long.

We must incentivise the market to make long-term sustainable investment choices.

In a traditionally opaque industry, supporting shareholders to get more involved can help increase transparency and accountability of decisions, which is particularly important for long-term climate action. Working together to develop better transition plans will ultimately benefit the company and the shareholders themselves, so we must give them more of a say.

First published by City AM. Alexander Stafford MP (Rother Valley) is a member of the Conservative Environment Network.

Comments